The Only Guide for Credit Union Near Me

Table of ContentsWhat Does Credit Union Near Me Mean?The Facts About Credit Union Near Me RevealedThe Greatest Guide To Credit Union Near MeNot known Facts About Credit Union Near MeCredit Union Near Me Can Be Fun For EveryoneThe 20-Second Trick For Credit Union Near MeHow Credit Union Near Me can Save You Time, Stress, and Money.

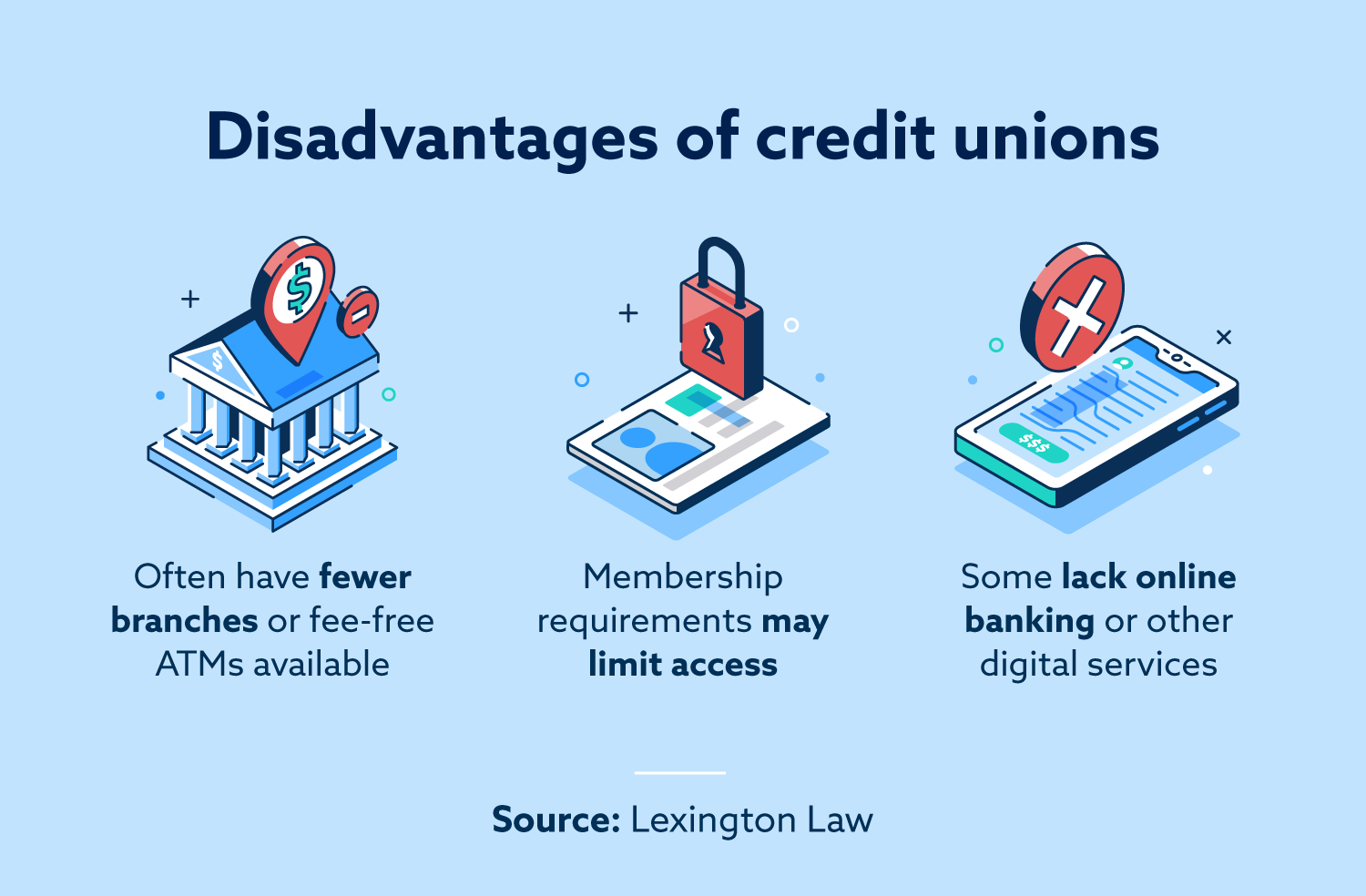

When you become a member, you can open cost savings and inspecting accounts and acquire loans and charge card. The majority of offer some level of financial investment services as well. Rather than making cash by charging clients interest and fees and then reinvesting it all for the service's revenue, credit unions return their profits to their members in the kind of lower-rate loans and higher-rate cost savings accounts.

When you join a credit union, you become an owner, and that status equates into certain privileges: Credit unions offer some of the best rates on credit products such as car loans, home mortgages and credit cards.

Credit Union Near Me Things To Know Before You Get This

That can be a substantial relief when your funds dip into the single digits. If you do not have a credit report or do but it's harmed, you could have major difficulty scoring a charge card or loan with a low rate from a bank. Credit unions are more flexible of people in this position.

Credit unions tend to offer higher interest rates on savings and bank account than banks do. Massachusetts-based Digital Credit Union, for example, currently provides members an impressive annual yield of 6. 7%on the first $1,000 in their primary cost savings account. And these accounts are as safe and secure as those supplied by industrial banks, considering that they are also guaranteed. credit union near me.

Credit Union Near Me for Beginners

Desire to have all of your accounts in one location, consisting of charge card? Most credit unions use them, however there might not be a variety of credit cards from which to pick. Those with substantial sign-up bonuses and other specialized rewards programs most likely will not become part of the lineup. credit union near me. Credit unions often accommodate a specific neighborhood or occupation.

Everything about Credit Union Near Me

To end up being a member of State Worker' Cooperative Credit Union, you'll require to be an employee of the state of North Carolina. Still, credit unions might be worth considering if you're unhappy with your bank or are trying to find a more community-focused environment. If you think a cooperative credit union might be a great option for you, but you're not exactly sure if you're qualified for any in your community, do not offer up.

"Individuals instantly think they can't join since of the name or stress that it's some sort of club. That's not true at all. You can find a credit union that's right for you. Examine out what remains in your area, then stroll in the door and talk with someone." If you do, possibilities are a friendly agent will welcome youand may draw you in as a brand-new member of the household.

Getting My Credit Union Near Me To Work

Today's clients are looking for more than simply an institution to assist them manage their money. They want to discover a place that not only takes care of its members, offering excellent rates and competitive services, however also contributes to the well-being of their neighborhoods, rather than that of their shareholders.

4 Easy Facts About Credit Union Near Me Explained

So how does the non-profit and member-owned characteristics of a cooperative credit union specifically assist its members? By focusing instead on members and passing on the benefits to them, credit unions can offer the following benefits. A credit union's concentrate on its members, not its earnings (and the accompanying nonprofit, tax-exempt status), implies that instead of making money off of clients, excess revenues and savings are passed onto consumers.

Things about Credit Union Near Me

Instead, one major advantage of nonprofits is that get more members can get much better interest rates:. From home loans to vehicle loans, cooperative credit union are typically able to offer the most affordable interest rates on loans. If you're trying to find a place to grow your cost savings, the rate of interest on cost savings accounts, money market accounts, along with certificates can be much higher than those this link used at banks.

At Palisades, this consists of: Credit unions can lower the barriers to acquiring a home loan for their clients. Even if your credit is less-than-perfect, a credit union may be able to assist you protect a home loan when banks turn you away.